How Banks Can Meet – and Exceed – the Customer Expectations of Fintechs

By design, fintechs are built to match the digital expectations of younger consumers, creating solutions that deliver friendly user experiences and easy accessibility, two things Gen Z and Millennials value when looking for a financial provider.

But this isn’t to say that younger consumers are opposed to working with traditional banks. In fact, market data reveals that Gen Z and Millennials still prefer to bank with the trusted institutions of their parents.

However, banks may be relying too heavily on family legacy to keep younger consumers banking with them. While Gen Z and Millennials may have accounts at banks, becoming their primary bank is at stake. According to a U.S. retail banking survey done by Qudini, 32% of Millennials who use challenger banks said they were strongly considering using their challenger bank as their sole provider – and 100% of Gen Zers said they were already doing so.

Down the road, banks may pay a steep price for not acquiring and retaining these younger customers. Building and nurturing relationships when people are just starting their financial journeys is what shapes them into long-term, high-value loyal bank customers.

So how do banks gain the attention of Millennials and Gen Z in a sea of fintechs?

Beat them at their own game by offering the same fintech solutions – but backed by generations of trusted experience and demonstrated security. Topping this list: Buy Now, Pay Later (BNPL).

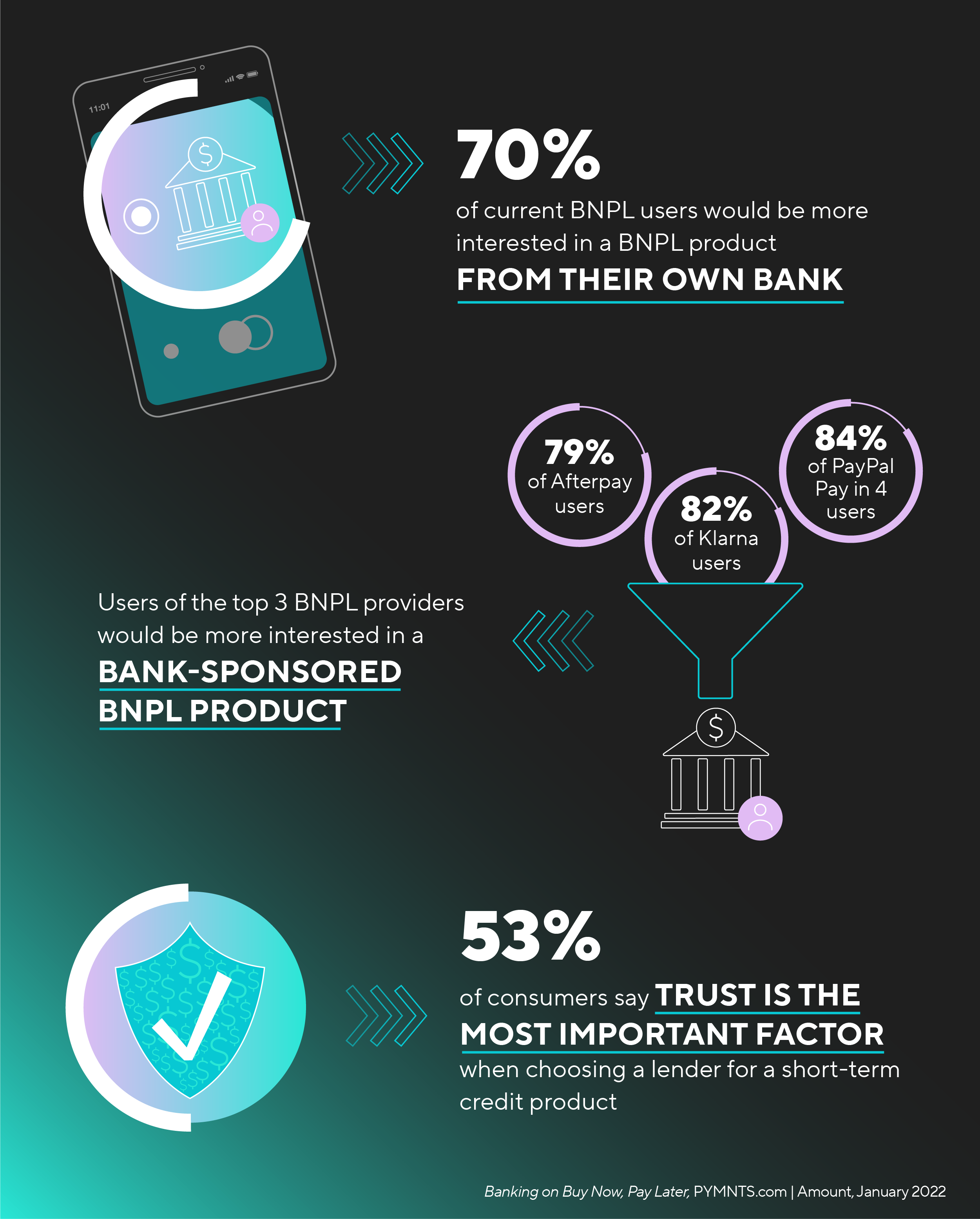

In Amount’s recent BNPL consumer research study Banking on Buy Now, Pay Later, completed in conjunction with PYMNTS, we found that 70% of current BNPL users are interested in bank-issued BNPL plans as compared with nonbank BNPL offerings, and more than three-quarters of consumers who use BNPL from the top three BNPL providers are interested in switching to bank-issued BNPL plans. Considering that Gen Z and Millennials make up 64% of BNPL users today, being able to offer BNPL is a surefire way legacy institutions can appeal to the financial priorities of new and younger consumers, which are projected to spend $1 trillion globally via BNPL by 2026.

Even more, consider the inherent advantage of a bank-issued BNPL plan. In our BNPL consumer research “trust in the credit provider” was the most important factor when consumers choose a BNPL solution. We all know trust and security are the bread and butter of banks, the result of years of experience and regulatory oversight ingrained in their solutions, and this reputation is not lost on younger consumers: 60% of Millennials and 54% of Gen Z respondents showed interest in a bank-backed BNPL plan.

Clearly, banks have a lot to offer younger consumers by way of trust and security. But to acquire and keep this next generation of desirable bank customers, banks need to meet their expectations with digital and easily accessible solutions that relate to their top priorities – which doesn’t actually require an overhaul of a bank’s existing infrastructure. Today, there exist technological solutions that seamlessly integrate into a bank’s system of record, transforming historically inefficient, inflexible legacy infrastructure into a secure powerhouse for high-value omnichannel solutions. By leveraging strategic partnerships to rapidly digitize processes and accelerate speed-to-market with differentiated, customer-centric solutions, banks are uniquely equipped to take back leadership in the personal loan space.

While younger consumers have shown interest in having challenger banks as their sole providers, the race has not yet been lost for banks. By building upon the deep-rooted trust and security associated with banks with seamless and convenient digital offerings, banks can not only meet the customers expectations set by fintechs – they can exceed them.

To learn more about consumers' interest in using bank-backed BNPL plans, download our report "Banking on Buy Now, Pay Later."

Download Report

Download Report