It’s tempting for banks to dismiss the emergence of Buy Now Pay Later (BNPL) as a fad.

After all, the idea of providing consumers with credit at the point of sale (POS) is hardly new. For decades we’ve cycled between different versions — layaway, private label credit cards, POS loans — and none of them have ever substantially disrupted the status quo.

Why should BNPL be any different?

But that’s the thing about disruptive innovation: It requires more than a good idea—it requires the right conditions for that idea to take root and thrive.

And there’s reason to believe that the conditions in today’s consumer credit ecosystem are nearly perfect for the emergence and rapid growth of BNPL.

What Exactly is BNPL and Why Now?

Let’s start with a definition.

BNPL is a segment of consumer credit products that enable consumers to spread the payments for a specific purchase out across a longer period of time at either 0% interest or at a low APR (depending on the specific BNPL product). These installment loans are delivered instantly at the point of sale for both e-commerce and brick-and-mortar merchants.

There are three key changes in the consumer credit ecosystem that have, over the last 15 years or so, created the conditions necessary for BNPL to emerge:

1. Automated credit decisioning

Historically, a key constraint in the consumer credit ecosystem was the amount of time and work that went in to underwriting a consumer for credit. These costs are what made credit cards so appealing — a consumer only had to be underwritten once and then they could use credit repeatedly without any additional intervention from their bank. The development of automated credit decisioning that could underwrite a majority of applicants in seconds represented a significant shift.

2. Modernization of Merchant POS

Another challenge in underwriting consumers for credit at the point of sale was that the POS systems that merchants used weren’t designed to change. This meant that introducing new experiences (like 0% financing) that required changes to the POS system were prohibitively expensive and time-consuming for all but the largest merchants. The digital transformation of the merchant commerce stack, both brick-and-mortar and ecommerce, in the last 15 years has all but eliminated this constraint. Today, every merchant POS system is designed with modularity in mind.

3. A preference for installments

As difficult as it might be for banks to understand, with credit cards being so ubiquitous, younger Millennial and Gen Z consumers don’t love revolving credit. For many of them, the benefits (rewards, near-universal acceptance, etc.) don’t outweigh the costs (compounding interest on balances, late fees, etc.) As installment lending has become more prevalent, younger consumers have become increasingly enamored with its virtues (fixed terms, transparent costs, etc.)

What do these changes mean for banks?

If they ignore BNPL, they do so at their peril.

Understanding the BNPL Ecosystem

According to a recent estimate from McKinsey, fintech companies providing BNPL products have already siphoned $8 billion to $10 billion in annual revenues from banks. With the share of consumer credit originated at the point of sale expected to increase from 7% in 2019 to 13-15% by 2023, the situation is poised to become significantly more challenging.

Overcoming this challenge requires, first and foremost, understanding exactly what banks are up against.

So let’s take a quick tour of the BNPL ecosystem.

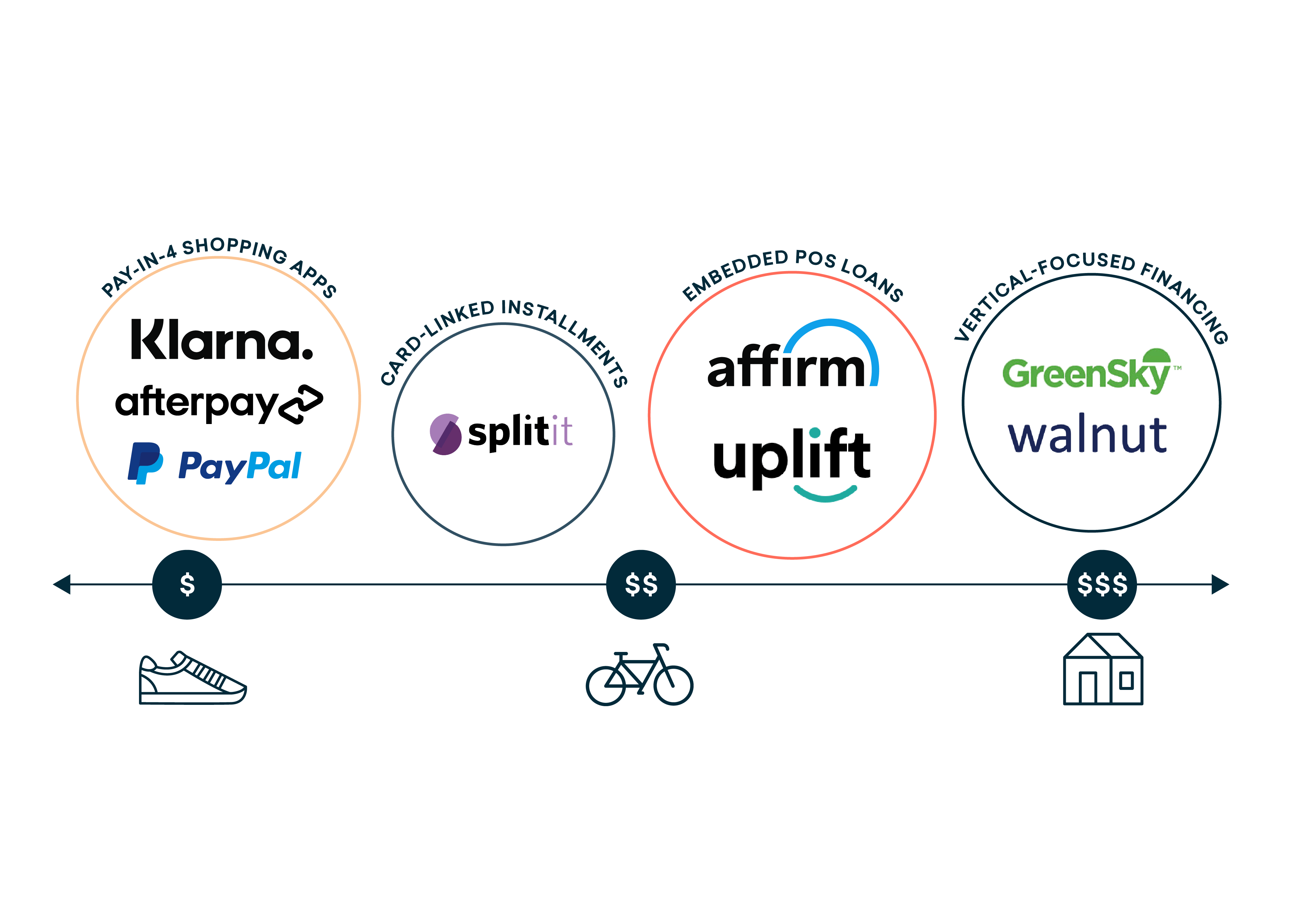

Pay-in-4 Shopping Apps

The simplest and most accessible form of BNPL, products in this category enable consumers to split smaller dollar transactions (typically less than $250) into four payments, with the first payment made at purchase and the remaining three payments due in two-week intervals. These loans are subsidized by merchants —commonly in apparel and footwear, fitness, accessories and beauty — in order to improve sales conversion rates and increase average order value and are offered at 0% interest to consumers, with no credit check required.

While pay-in-4 providers like Klarna and Afterpay started by integrating directly into their merchant partners’ checkout pages, they have since evolved into full-fledged shopping apps designed to convert first-time users (acquired through the merchants) into repeat customers that begin their subsequent purchase journeys from the pay-in-4 providers’ apps. The transition to this “shopping app” model is still in the early innings, but Afterpay reported that 17% of its customers initiated transactions from within its app in February of 2021.

Card-linked Installments

An emerging alternative to the Klarna/Afterpay pay-in-4 model is card-linked installments. This capability, offered by providers like Splitit, allows a consumer to break a planned payment out into installments using their existing credit card. This model, which is dependent on merchant partnerships, is potentially advantageous to consumers that already have and prefer to use credit cards, which may be why traditional players in the ecosystem (large issuers, card networks, etc.) are exploring similar solutions.

Embedded POS Loans

For more expensive purchases (between $250 and $3,000) in categories such as electronics, furniture, home fitness equipment and travel, providers like Affirm and Uplift offer consumers installment loans, integrated through merchants’ checkout pages. These loans have nine- to 12-month terms and may or may not charge interest, depending on the customer’s credit worthiness and the merchant’s interest in subsidizing the transactions.

Consumers that use these loans tend to have prime credit scores and multiple options for financing larger purchases (including credit cards). They use embedded POS loans because of the convenience, the flexible payment terms or, if it’s offered, 0% interest.

Vertical-focused Financing

For specific verticals like healthcare and home improvement, where transactions can run anywhere from $3,000 to $50,000, new fintech companies are emerging to challenge banks’ legacy unsecured installment lending and home equity lending products. Companies like Walnut (healthcare) and Greensky (home improvement) partner directly with the companies that consumers use to get these services, which gives them a significant distribution advantage over banks.

BNPL isn’t the perfect answer for every consumer, nor are the existing array of fintech providers unassailable. But BNPL has quickly grown into valuable tool for merchants and consumers alike. BNPL is here to stay, and the faster that banks accept that fact, the easier it’ll be for them to get off the sidelines and into the game.

To learn more about BNPL and how to find the right fit for your organization, read "Buy Now, Pay Later Partnership Models: Which is Right for your Institution?"

Read Article

Read Article