Buy-Now-Pay-Later Partnership Models: Which Is Right for Your Financial Institution?

Over the past year, buy now pay later (BNPL) financing has been heating up, becoming what is now arguably the hottest financing trend today. According to FIS’ The Global Payments Report 2021, BNPL is the fastest-growing online payment method globally. In fact, $995 billion is expected to be spent through BNPL options by 2026 (up from an estimated $226 billion in 2021), according to a recent report by Juniper Research.

Early FinTech movers like Affirm and Afterpay continue to own a large share of the BNPL market, but more traditional financial institutions have chosen to join the space and offer new products via partnerships with SaaS providers.

Needless to say, BNPL financing is where everyone wants to be—and should be—right now.

If you’re considering entering the BNPL market but aren’t sure what the best approach is, there are several BNPL partnership strategies between financial institutions, merchants and tech providers that have seen great success. While the core objective of these partnerships is the same—to provide consumers with flexible payment options—the success of these partnerships is greatly dependent upon the organization and its goals.

Here we break down the three most common strategic partnerships to help you determine which model may be the

best fit for your financial institution.

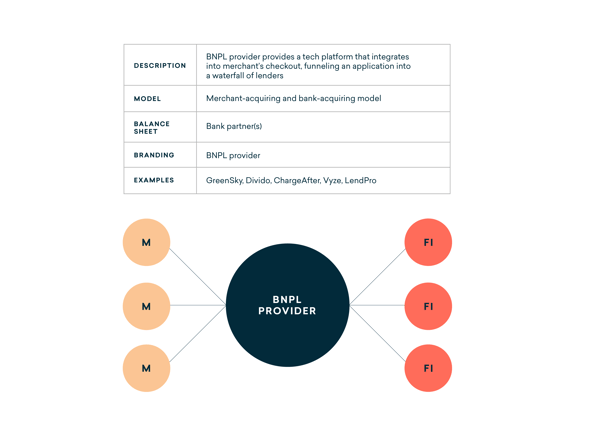

Marketplace partnership

What is the marketplace partnership?

The marketplace partnership quickly allows merchants to connect to a network of lenders via the BNPL provider. Compared to other BNPL models, the marketplace model connects consumers with multiple, competing financial institutions so that consumers can find the best option for the purchase. This approach leads to higher acceptance rates and lower fees for customers, given that they will be connected with their best fit lender.

Examples of these providers include GreenSky, Divido, ChargeAfter and Vyze, servicing merchants like BMW, Wayfair and Home Depot.

Pros / Cons to the marketplace model:

Financial institutions can benefit from this model, as the BNPL provider does most of the heavy lifting. Integration is straightforward and merchant acquisition is on the BNPL provider to accomplish. However, since the marketplace model connects multiple financial institutions with a single merchant, your financial institution will have to remember that you’ll be competing against each other. Also, the BNPL application will not include your financial institution’s branding. Instead, the BNPL provider will use their own.

Is this the right fit for you?

If your financial institution is willing to trade recognition and being prioritized for a quick integration, then this is a viable option.

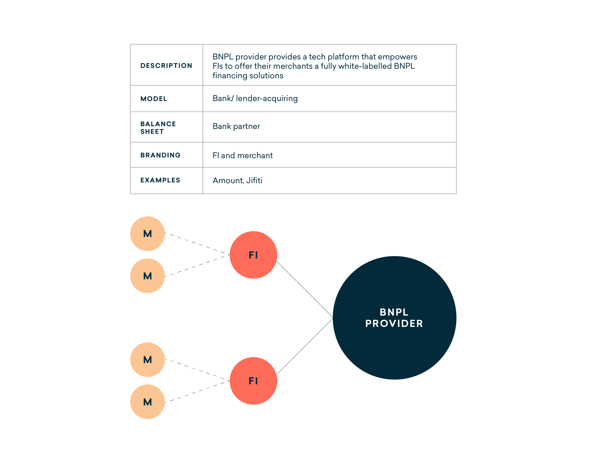

Rent-a-platform partnership

What is the rent-a-platform partnership?

The rent-a-platform partnership model requires a BNPL tech provider to equip a financial institution with a platform that a financial institution can offer merchants. This gives your financial institution the ability to hand pick which merchants get to use your platform. White-labeling capabilities and ownership of the platform allow for your financial institution to have a stronger presence and voice.

Examples of these providers include Jifit and Amount, which services financial institutions like Barclays, TD Bank and BBVA.

Pros / Cons to the rent-a-platform model:

The rent-a-platform model allows financial institutions to offer a differentiated product they can control. This is made possible with branded content and direct engagement with the merchant. While this platform takes time to launch, this model offers unmatched personalization. With the attention focused on the financial institution over the BNPL provider, this model can help drive new and existing consumer engagement.

Is this the right fit for you?

If your financial institution values offering a differentiated product to your chosen merchants and consumers, then this is the right option for you.

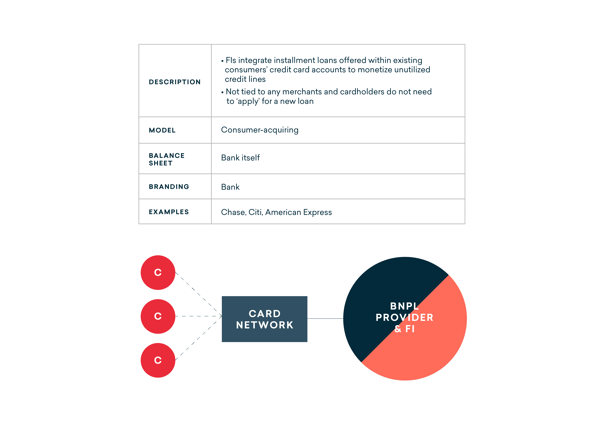

Card platform partnership

What is the card platform partnership model?

With a card platform partnership, card networks facilitate point-of-sale transactions between the issuing financial institution and the consumer on their existing credit cards—meaning card holders are still able to reap the benefits of credit card points. With this model, the card issuers are not directly tied to any merchants, and cardholders do not need to “apply” for a new loan. The card platform partnership model is a feasible option for financial institutions with existing card network relationships. Customers can access the BNPL funding option after they have already made a purchase on the card. Known as “post-purchase BNPL,” with this option, the customer must log in to their credit card account and select the BNPL funding option.

A few examples of card-issuers currently using the card platform partnership model are: Citi Flex Pay, My Chase Plan and AmEx Pay It Plan It.

Pros / Cons of card platform partnership model:

This model is a good fit for financial institutions that currently offer credit cards and are looking to further engage with existing customers. By integrating BNPL into a credit card, financial institutions will be able to strengthen their relationship with current customers. However, this model of BNPL functions as an afterthought for customers.

Unlike the models discussed above, the BNPL funding comes after the customer has made a purchase. This limitation hinders a financial institution’s ability to engage customers. Additionally, recruiting new customers will be difficult with this model. Customers will need to sign up for the credit card to be able to use this model of BNPL funding.

Is this the right fit for you?

If your financial institution currently offers a credit card, this model would be a safe bet. However, post-purchase BNPL has not seen the same explosive growth over the past year as other BNPL models.

Finding the right fit

The BNPL explosion we’ve seen during the past year has been largely driven by a tremendous shift in the behaviors of consumers, who want immediate, friction-free shopping experiences. Choosing the right BNPL model for your organization comes down to the unique demands of your customers.

While the marketplace model offers easy integration, financial institutions have to compete against each other. Since the model connects multiple lenders to one merchant, each consumer will be matched with their best fit lender. Unfortunately, the consumer’s best fit may not be your financial institution. Additionally, this model treats the financial institution as a background player and avoids driving attention back to it.

The rent-a-platform model offers the opposite solution. Financial institutions get a branded platform, new and existing consumer retention and direct interaction with their chosen merchants. While this platform takes more time to build, the end result is unmatched.

If your financial institution is looking for faster integration, look no further than the credit card partnership model. By integrating with an existing credit card, financial institutions can strengthen their relationships with current customers. However, this model makes it difficult to drive new customers, as the post-purchase BNPL option surfaces after the customer makes a purchase.

With BNPL financing gaining popularity at a rapid pace, merchants, lenders and consumers alike are on the lookout for their best fit. Luckily, there are many options that can position you for success.

To learn more about how POS strategies help create differentiated offerings that drive stickiness and brand loyalty, watch our webinar "This Isn't Your Typical Recession: A New Age of Point-of-Sale Financing."

Watch Now

Watch Now