The pandemic of 2020 and 2021 had a profound impact on small businesses. According to a May 2021 survey of small business owners by Bank of America, 85% of small business owners said the pandemic created extra stress around running their business.

The pandemic also changed small businesses’ use of technology. In this same study, 62% of respondents said they adopted new digital tools and strategies, with 36% doing more business banking online or in mobile apps; 30% accepting more forms of cashless payments; and 26% creating and/or improving their social media presence.

The Small Business Opportunity for Banks

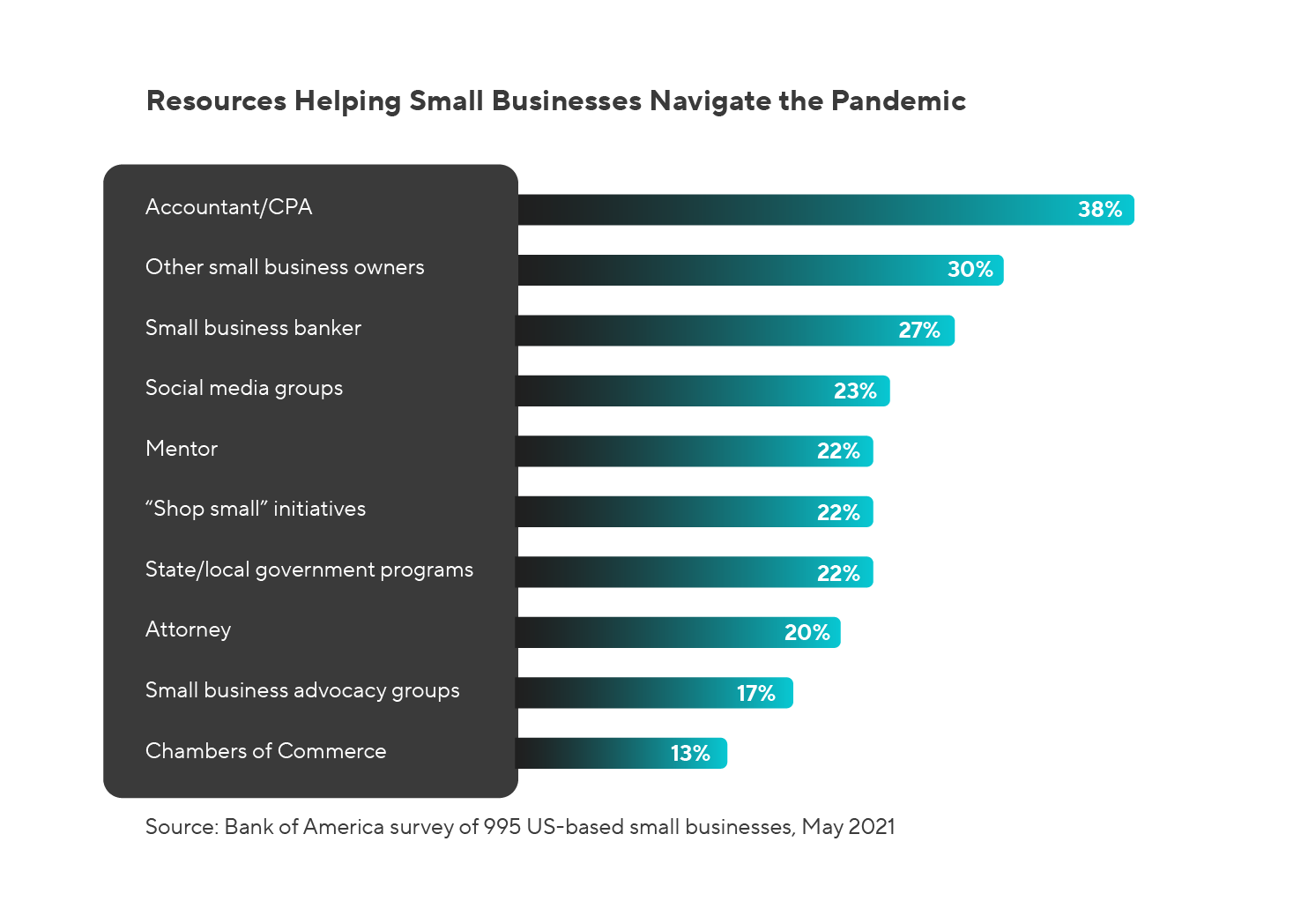

Banks have an important role to play in helping small businesses cope. More than a quarter of small businesses said their small business banker played a role in helping them navigate the pandemic, behind other small business owners and the small business’ accountant (Figure 1).

Although small businesses turn to banks for help, many are reevaluating their relationship with their financial services providers. According to a study by Kabbage, 32% of small businesses changed financial services providers in 2021, and of those who haven’t changed providers, about one in four anticipated changing their business checking accounts by mid-2022.

Why did the switchers switch?

The most popular reason—cited by 24% of small businesses in the Kabbage study—was to find a provider that allowed them to manage everything with one company. In addition, 22% changed providers because they wanted product features that made it easier to run their company, and 21% said they changed to get better digital banking capabilities.

Banks Need to Up Their Digital Games

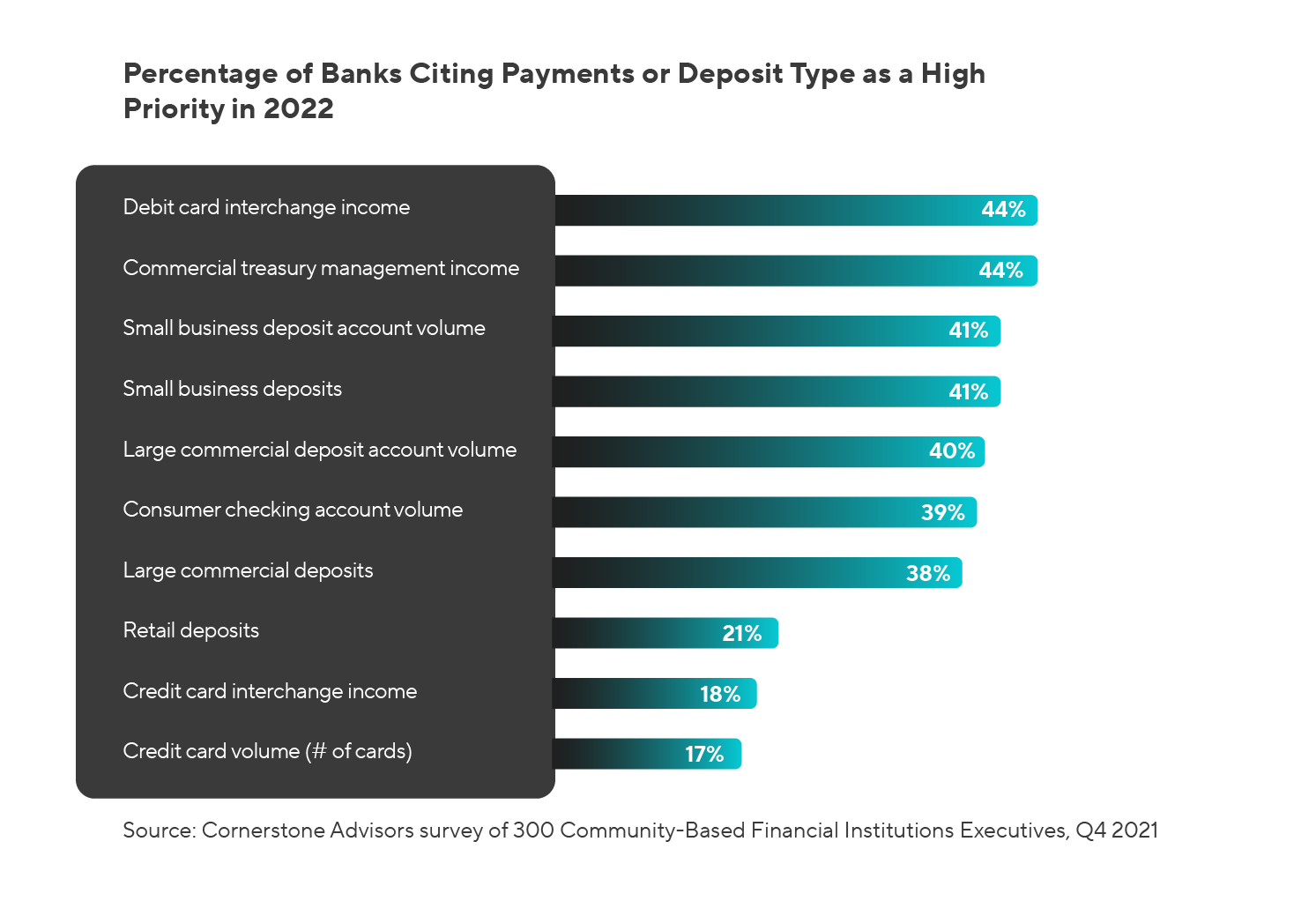

In the list of banks’ deposits and payments-related priorities for 2022, small business deposits and deposit accounts are near the top of the list (Figure 2).

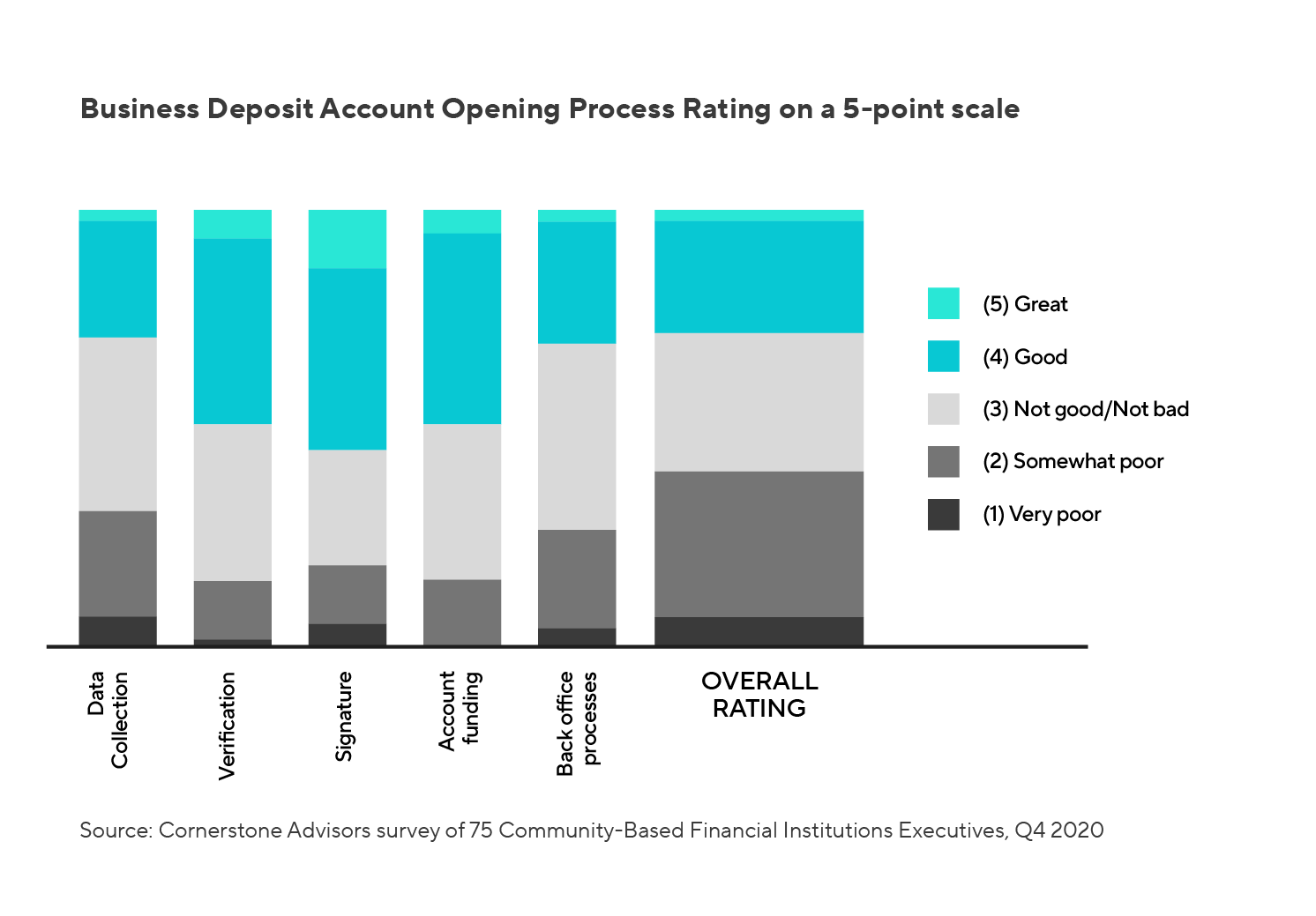

In a Cornerstone survey of mid-size banks, however, more than half said that their account opening process limits their ability to grow business deposits. What is it about their account opening process that hampers their ability to grow? Just about everything. Overall, 40% of banks rate their small business account process as “somewhat” or “very poor” while just 25% rate it as good and a mere 3% rate it as great (Figure 3).

Banks’ battle for small business relationships no longer involves just competing against other banks. Large, technology-driven platforms and providers are increasingly competing for the business that banks alone have traditionally provided. Fighting back—and competing successfully—requires banks to up their digital game. And to do that, they’ll need to start by delivering a digital account opening process.

Getting Digital Account Opening for Small Businesses Right

There are a number of things financial institutions need to do, however, in order to achieve these objectives:

-

Get a handle on the cost of account opening. Financial institutions that don’t know the cost of onboarding new small business customers should be embarrassed. It may seem trite to say that “time is money,” but it’s applicable here because a higher-than-average cost to onboard likely means the process is slow and cumbersome. If an institution doesn’t know the cost of the process, it can’t identify and eliminate the bottlenecks, handoffs, and other unnecessary steps in the process.

-

Don’t find the needles in the haystack—knock the haystack down. There’s a tendency in many financial institutions to map out the (so-called) customer journey, find the components of the process that take too much or cause customers (or applicants) too much trouble, and fix that component. It’s the wrong approach when moving to digital account opening and onboarding. Moving to a digital process requires a complete re-thinking of the process.

-

Don’t fall into the compliance trap. Don’t worry—we’re not going to tell you that you can ignore compliance when migrating to a digital account opening process. But you don’t have to move to a compliance-first process. Designing a successful account opening process requires some out-of-the-box thinking. According to Chris Nichols at CenterState Bank:

“If you ask bankers what it takes to satisfy the regulations to open an account, they will give you a long list of items including signature verification, multiple forms of identification, etc. The reality is that it takes very little information to get an account open. The risk for opening a deposit account isn’t for bad actors to move money in, but to move money OUT.”

Banks should restructure the process to allow for the simplest account opening and funding possible, and then work to reduce risk and satisfy the regulation.

-

Focus on the account opening “moments of truth.” The digital account opening and onboarding process will be comprised of many steps, but there are five things banks and credit unions must get right: 1) Minimize customer data entry requirements; 2) Create a one-step process for account funding; 3) Prevent application abandonment by providing digital and human support at every point in the process; 4) Provide E-signatures and paperless document delivery; and 5) Enable accounts to be opened and available for use immediately upon application completion.

-

Establish an effective performance measurement system. Financial institutions should track and measure digital account opening performance measures that include—but aren’t limited to—metrics like completion rates, time to complete, and resume rate. A completion rate below 30% is a warning sign of a complex process that has too many steps, takes too long, or requires data not readily available. For checking accounts, a process that takes more than 15 minutes is a signal that extraneous information is being collected. Generally, the longer the application, the more likely it is to be stopped or abandoned. The resume rate is an indicator of how successful the institution is at resuming the application at a later point.

As Javelin Research observed:

“Account opening is a tremendous opportunity for banks to demonstrate their omnichannel competence, save on costly administrative and transactional branch visits, cross-sell additional accounts and products, and onboard new customers into digital services that build engagement and lead to long-term profitability.”

Doing digital account opening right, however, requires some fresh new thinking on the part of banks. Their efforts promise to pay off handsomely.

To learn more about how small business bankers can up their digital game, watch the on-demand webinar "The Art & Science of Digital Small Business Lending."

Watch Webinar

Watch Webinar