Despite the enormous growth in Buy Now Pay Later (BNPL) over the last several years and the emergence of massive, highly formidable BNPL providers like Klarna and Affirm, there is still significant opportunity for banks to play an important role in this hot, highly competitive new market.

Banks can win in BNPL.

However, before they can succeed, banks need to acknowledge and learn from the early mistakes that some have made in responding to BNPL.

Missing the Mark

What do you get when credit card executives at big banks take the lead in responding to a new lending solution that is beginning to eat into their products’ margins, especially with coveted Gen Z and Millennial customers?

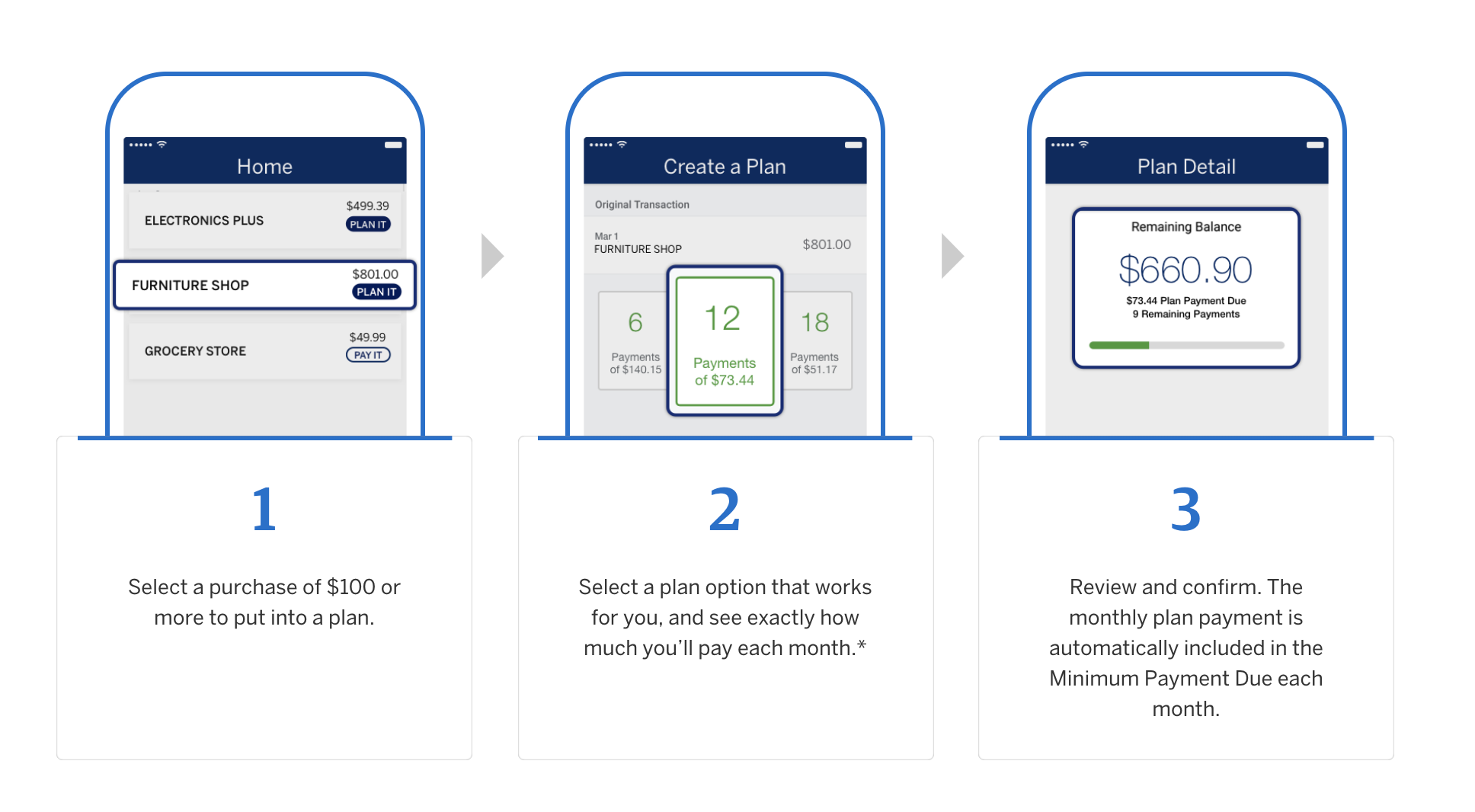

A bolt-on installment lending capability that allows cardholders to retroactively convert large purchases (typically $100 or more) into a series of monthly installment payments for a small additional fee or additional interest.

This retroactive BNPL capability — offered by large issuers like JPMorgan Chase, Citi and American Express — offers a lot of advantages … for the banks. It keeps customers using their credit cards, which preserves existing interest and interchange revenue streams. It generates additional revenue. And it doesn’t require launching an entirely new product, acquiring new customers or building direct partnerships with individual merchants.

The only problem is that it’s a little hard to see any advantages for the customer when compared to non-bank BNPL products.

Retroactive BNPL isn’t convenient to use — customers have to go back into the mobile app after the transaction rather than making the decision to use it at the point of sale. Retroactive BNPL doesn’t help customers avoid revolving a balance on a credit card and paying interest on it. And retroactive BNPL actually costs customers more, by assessing fees (and sometimes interest) on each transaction that is converted into installments.

Retroactive BNPL is, both literally and in a more abstract, strategic sense, backward-looking. It was designed by bank executives trying to preserve the status quo rather than deliver new value to a rapidly changing customer base.

Day One

BNPL providers like to claim that their products are a superior option to credit cards for consumers that want to get periodic access to credit without going deeply into debt. However, like credit-card issuers, BNPL providers are financially incentivized to encourage consumers to spend, and there is emerging evidence that consumers’ BNPL-enabled spend is starting to impact their overall financial health.

To win in BNPL, banks can’t look backward. They can’t impose constraints on the way that their customers use their products or the products of their competitors.

To borrow a page from the playbook of a famous disruptor, banks need to treat every day as “Day One” and start from the assumption that their customers can—and will—pay anywhere any way.

Then they need to figure out how they can earn the business of their customers by designing new lending and payment solutions that address the needs of consumers (and merchants) in ways that existing solutions, including BNPL, fail to do.

Here are a few ideas:

White-labeled BNPL

A conflict of interest looms in BNPL between merchants and large BNPL providers like Affirm and Klarna, both of which are keen to control the ongoing relationship with the end customer. This conflict may spur merchants to look for financing partners that are comfortable fully white-labeling their capabilities in order to deliver the value that merchants expect from BNPL (higher conversion rate, bigger average order sizes, etc.) while avoiding this fight over the customer relationship. Banks, with their large existing customer bases built independently from merchants, are well-positioned to play this role.

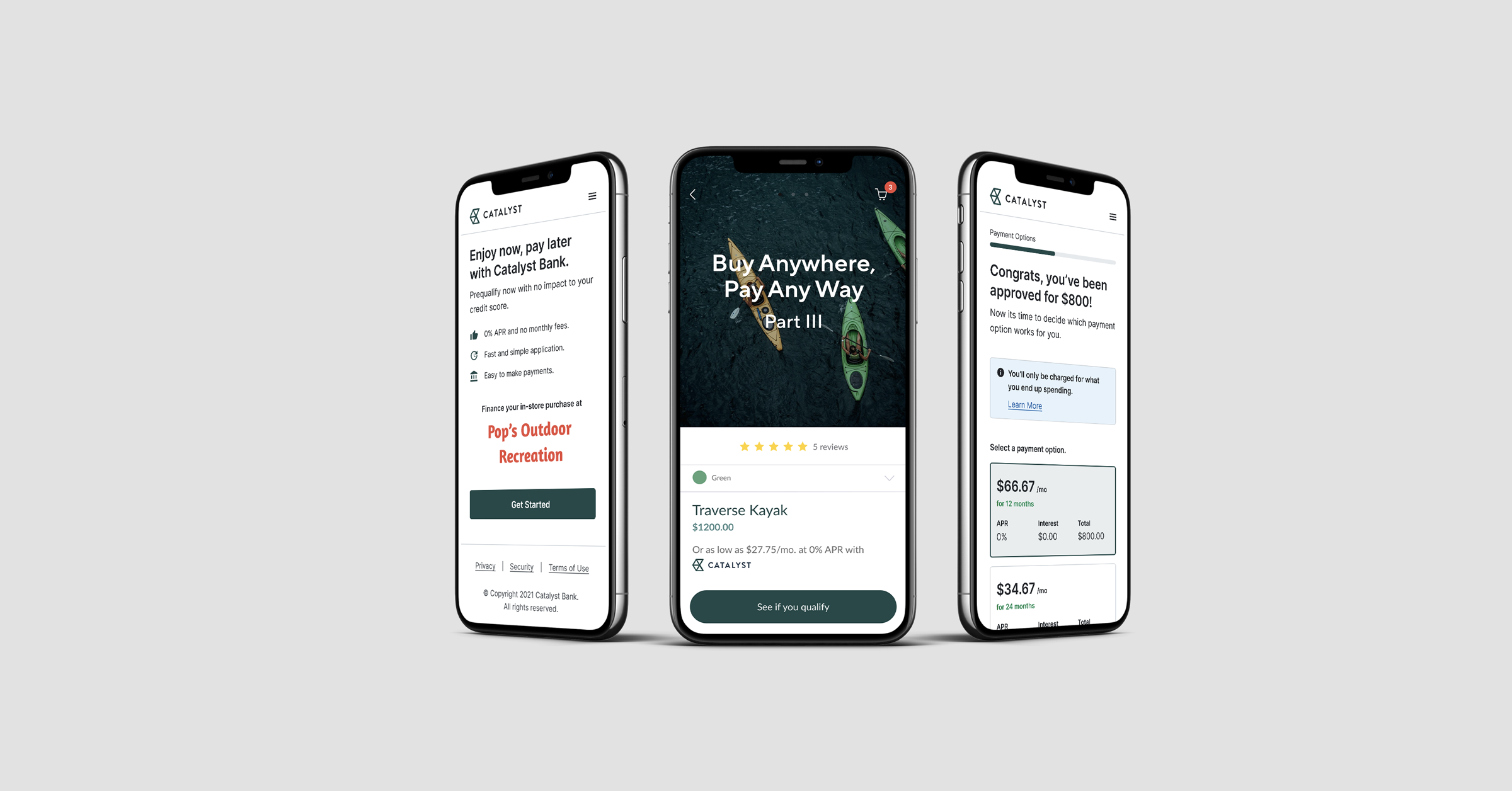

Vertical-specific POS Lending

Competing with large BNPL providers across every merchant category is, for most banks, an unrealistic goal. However, there are likely opportunities for banks to outcompete fintech companies within specific verticals, particularly in the ones that they already serve. Banks could build vertical-specific BNPL solutions for their existing commercial clients, incorporating all of the industry-specific risk underwriting and workflow requirements necessary to create an outstanding experience for those clients’ end customers. Going a step further, banks could leverage their relationships with commercial manufacturers — the companies that supply goods to merchants — in order to enable those manufacturers to create product-specific discounts and incentives that could be delivered to the end customer (through the merchant) using the bank’s BNPL capabilities.

BNPL Platform for Small Businesses

While competition for partnerships with the largest merchants — your Targets and Amazons — has already reached a fever pitch, there’s no reason why small businesses wouldn’t be interested in offering BNPL to their customers as well. The challenge is making BNPL accessible for small businesses, at scale. Square is solving for this challenge by acquiring Afterpay. Shopify has partnered with Affirm to enable BNPL for its merchants. However, there are a lot more small businesses out there to serve. Banks could build a platform, in the mold of RouteOne and Dealertrack, for small businesses to connect to in order to get access to BNPL financing that meets the unique needs of their customers. The bank could directly lend to small businesses’ customers through this platform and enable third-party lenders to do so as well, ensuring sufficient capital and risk appetite to support a large network of small businesses.

Debit + BNPL + Budgeting

BNPL providers make money each time they facilitate a transaction for a merchant. That’s core of the business model. This creates a natural conflict of interest: When a consumer is contemplating making a purchase, the BNPL provider will always be incentivized to encourage that purchase. Banks, by contrast, get paid by consumers. This, in theory, incentivizes banks to help consumers balance their short-term desire to spend with their long-term goals to save money and improve their overall financial health. Banks could build a BNPL solution — a debit card with built-in BNPL lending capabilities — that helps customers strike this balance. Additionally, banks could build budgeting functionality into this solution that allowed customers to link all of their existing BNPL loans, across providers, in order to track their loans in a single and get a unified view into their current and future cashflow.

Stop Looking Backward

There are opportunities for banks to succeed in BNPL, but this will only happen if they stop looking backward — hoping for a return to a world in which credit cards were the only game in town — and focus on finding ways to add new value for consumers and merchants.

To learn more about BNPL and how to find the right fit for your organization, read our recent post "Buy Now, Pay Later Partnership Models: Which is Right for your Financial Institution?"

Read Article

Read Article